Home » Financial Resilience » Is gold a good investment in Q4 2024?

Is gold a good investment in Q4 2024?

Learn continually – there’s always “one more thing” to learn! – Steve Jobs

Gold prices have grown a lot in recent years. It is “on a tear”.

For the correct perspective one has to see a logarithmic chart (not linear) of the last 50 years (not just 5).

Since the decoupling from the gold standard in the 1970s – though that process had started decades earlier in the 1930s – gold prices have been more or less free floating i.e. driven by natural market supply and demand.

There was a massive period of lull from 1980 to 2000. In fact, it declined in value during that period, and again for a few years in the 21st century.

But the larger picture shows us that in the last 20 and 30 years, gold has performed quite well in USD terms. Almost matching the CAGR of the stock market.

Gold is seen as a hedge against stock market downturns as well as a safe-haven asset during times of crisis.

Does gold beat inflation?

Yes, it often does, but not every year. In fact, gold prices are quite volatile.

Does gold beat the stock market index total returns?

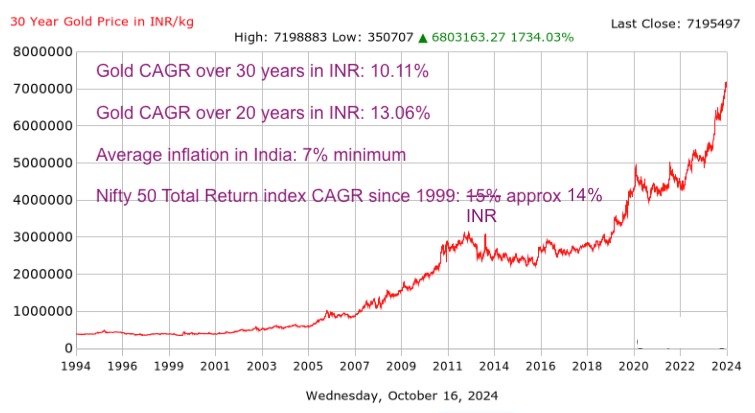

The above is a chart showing gold prices in INR since 1994 till 2004 – a period of 30 years. It is a linear scale chart, so the movements at higher prices are much more pronounced than similar movements (as a percentage) at lower prices. Also mentioned is the comparable period total returns (i.e. dividends reinvested) of the Indian stock market represented by the NSE Nifty index and the average historic inflation in India.

Inference: The real long-term returns (inflation adjusted) of gold are significantly positive and almost as much as the stock market.

Note: The above example is for India, without considering additional costs and taxes. Also the Indian stock market is among the best-performing markets in the last two decades. Other countries like Japan, Singapore, and EU members will likely see that gold prices have outperformed the returns by their respective stock market indexes.

Why is gold so “expensive”?

Expensive is a relative term.

Gold has sentimental value as a noble metal that is seen as precious and can be moulded to make expensive jewellery that pushes demand, while supply is kept limited. Though nowadays it has uses in electronics, medical procedures, and kept as a reserve asset – from nations to households.

Warren Buffett dislikes gold – because it does not reproduce itself, nor produce anything else like a piece of farmland or a share of a productive company would.

What helps it is that people feel like they understand it more readily than company stocks or even indexes. They can see, touch, mould, and wear gold in various forms. And it literally shines.

Price is always an intersection of supply and demand.

Who produces, holds, and consumes gold the most?

Like for diamonds, there is always speculation that gold supply is kept artificially low to boost prices through scarcity. The top 5 biggest producers of gold in 2024 are: China, Australia, Russia, Canada, and the USA.

The largest holders of gold in 2024 are the USA, Germany, Italy, France, Russia, China, Japan, and India.

The largest buyers of gold in 2023 were China, Poland, Singapore, Libya, and Czechia.

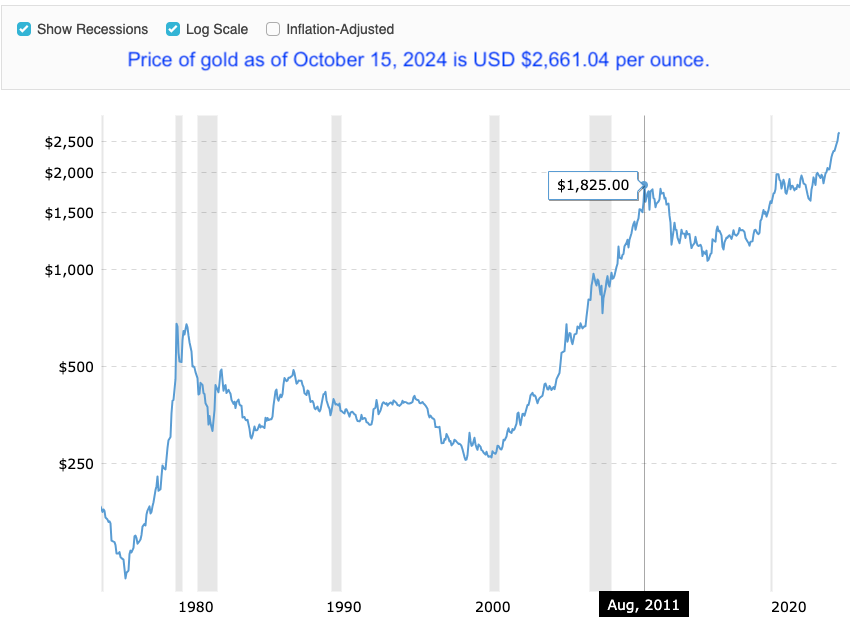

A useful graph to understand the history of gold prices:

Above is a 50-year log scale chart of gold prices in USD – from 1975 Jan till Oct 2024.

As you can see, the greatest bull 🐂 run was from 2000 to 2011. Gold went up 600% then (price became 7x).

Right now we are only about 50% up from 2011 high.

But then we can’t forget the huge decline of almost 50% over 20 years 1980 to 2000, when there was no end to the downfall in sight. We saw a sharp decline also from 2011 to 2014, but then it recovered the loss over the next 5 years.

Alternatives

Cryptocurrencies like bitcoin are considered the new digital gold because of its limited supply, easy transferability, and not being under the control of any one government.

Is gold an indicator of business sentiment and confidence in the economy?

It is logical to think that “big money” that is capable of moving the market prices chooses to park their resources in gold when they foresee economic headwinds i.e. tougher times ahead for business revenue growth.

Studies suggest that the correlation between gold prices and consumer sentiment indicators, such as the Consumer Confidence Index, is negative but weak, with a coefficient around -0.15 to -0.27. This suggests that while gold prices may rise when confidence in the economy is low, the relationship is not highly predictable. Gold tends to perform better during periods of stress or when markets expect inflation, economic downturns, or geopolitical instability

Conclusion

If gold can be seen as a growth asset over the long-term due to natural demand and supply factors, and one that has low correlation to other assets such as equities, then gold should certainly be considered for 5% to 10% of a high-quality diversified portfolio.

Comment: Is there any tip/hack that you have personally used in order to learn things quickly which has not been covered in this blog?

Let me know in the comment section below, I would love to hear your stories.

Share This Post, Choose Your Platform!

Categories

- Mental Resilience

- Emotional Resilience

- Financial Resilience

- Interpersonal Resilience

- Physical Resilience